By: Ranu Jain

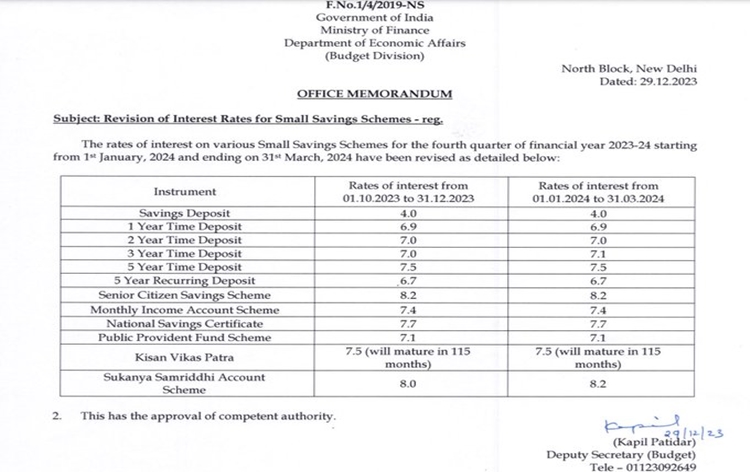

The Union government has announced a boost in interest rates for the Sukanya Samriddhi Yojana (SSY) for the January-March 2024 quarter, increasing it from 8% to 8.2%. The move underscores the government’s commitment to promoting financial inclusion and securing the future of the girl child.

Launched on January 22, 2015, as part of the Beti Bachao Beti Padhao campaign, the Sukanya Samriddhi Yojana is a unique savings scheme tailored exclusively for the welfare of the girl child. The scheme aims to assist in covering the education and marriage expenses of the girl child, motivating parents to establish a dedicated fund for their daughters’ future needs.

Individuals can apply for the Sukanya Samriddhi Yojana through post offices, branches of public sector banks and three private banks – HDFC, Axis and ICICI. Parents or legal guardians can open an account for a girl child under 10 years of age, with families allowed a maximum of two SSY accounts, making it a versatile and accessible savings option.

The scheme mandates a minimum annual investment of ₹250 and permits a maximum investment of ₹1,50,000 per annum. With a maturity period of 21 years, SSY provides a secure and long-term investment opportunity for families. Notably, all principal amounts, interest earned, and maturity benefits are tax-exempt under Section 80C, enhancing its appeal as a financial option.

Sukanya Samriddhi Yojana stands out as a tax-free savings scheme offering benefits at three levels. Firstly, individuals can avail tax exemption under Section 80C for annual investments up to ₹1.5 lakh. Secondly, returns on investment are tax-free, and thirdly, the maturity amount is entirely tax-free.

Since its inception, the scheme has gained immense popularity, with approximately 2.73 crore accounts opened, accumulating deposits totaling nearly ₹1.19 lakh crore. This widespread adoption reflects the growing trust and recognition among families regarding the scheme’s potential to secure the financial future of their girl children.

Sukanya Samriddhi Yojana continues to play a crucial role in promoting financial empowerment for the girl child. With the recent interest rate hike and its proven track record, SSY stands as a beacon for families seeking a brighter and economically secure future for their daughters. As families nationwide embrace this initiative, the scheme is poised to make a lasting impact on the financial landscape, empowering the next generation of young women.