The Reserve Bank of India (RBI) has urged retail investors to exercise caution while investing in cryptocurrencies, warning that the crypto ecosystem lacks accountability and stability and is marked by regulatory ambiguity.

In its monthly bulletin released Tuesday, the RBI said that the interest in cryptocurrencies is driven by speculative motives rather than as a mode of financial transactions.

The RBI assessment aligns with a survey by the UK Financial Conduct Authority (FCA) revealing that the majority of investors (38 percent) view investing in crypto assets as a ‘gamble to make or lose money’.

“Some cryptos may be backed by underlying assets; however, if the underlying itself is another unstable digital asset with no transparency and central bank backup, the crypto system is prone to crisis without safeguards,” the RBI bulletin said.

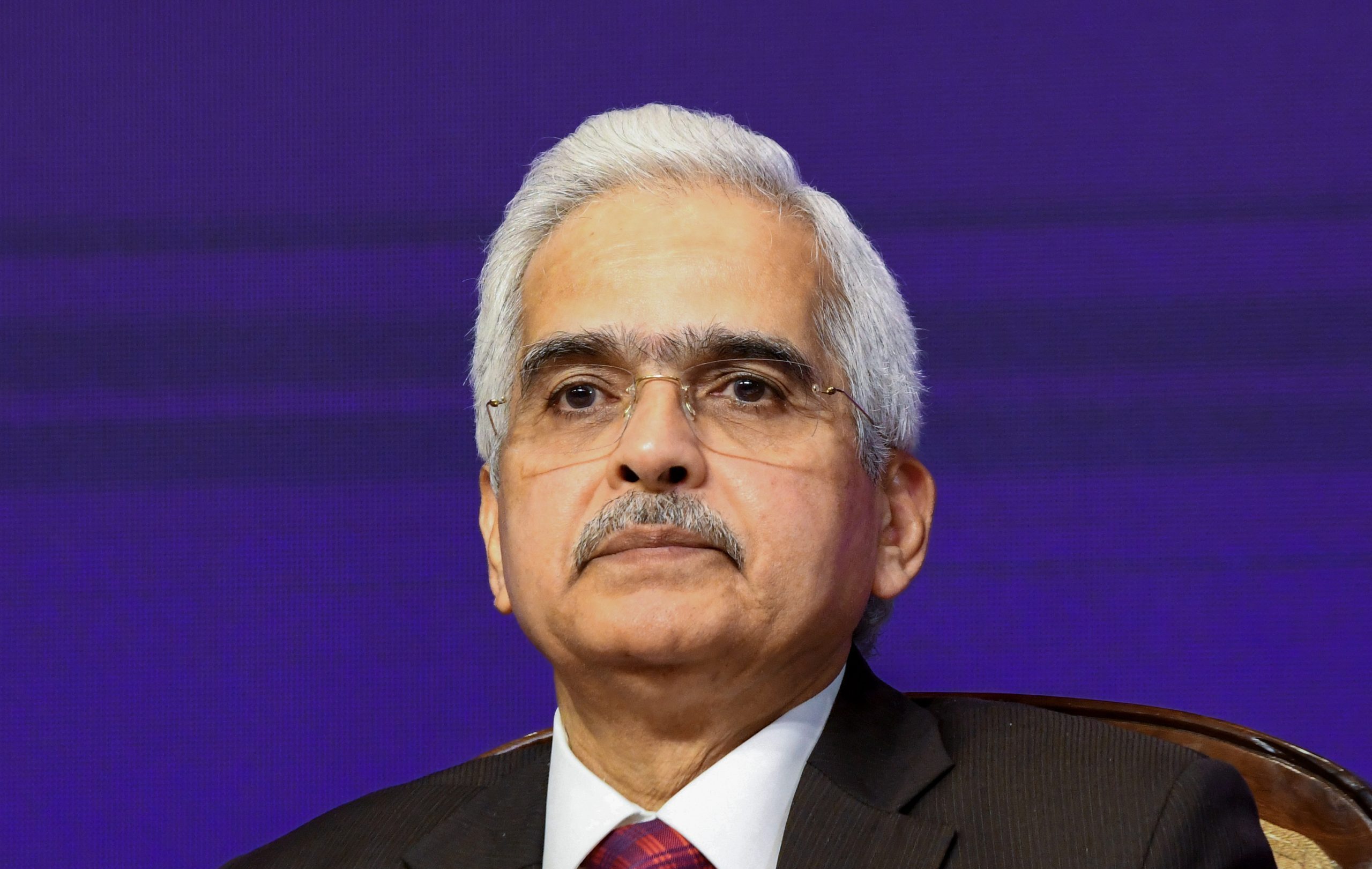

The bulletin reiterated RBI Governor Shaktikanta Das’s statement that “the term cryptocurrency, private cryptocurrency is a fashionable way of describing what is otherwise 100 percent speculative activity.”

The recent collapse of FTX and Binance exposed the limitations of country-specific rules/bans and the grave risks they entail.

“As DeFi (Decentralized Finance) continues to evolve and mature, and its interaction with the traditional financial system grows, its utility against risks demands further analysis,” the RBI said.

Earlier in May, Governor Shaktikanta Das had said that a Central Bank Digital Currency (CBDC) or digital currency could drive financial inclusion and provide a much safer alternative to potentially dangerous private digital currencies.

Private digital currencies, commonly known as cryptocurrencies, are currently unregulated in India. The Indian government does not register crypto exchanges and maintains that crypto assets, which are borderless by definition, require “international collaboration.”

India backs CBDC, with its unique technology, and believes it has transformative potential. Das asserts three key features of CBDCs—anonymity, ease of usage, and finality of settlements.

The digital currency was launched in India on a pilot basis, both in the wholesale and retail categories, in November-December 2022.

Among key learnings so far from the CBDC pilot, Das had said it has similar denominations to physical currency, which makes it easier for users to relate to CBDCs as a digital form of cash. It also offers a similar degree of anonymity to physical cash.

(Inputs from ANI)