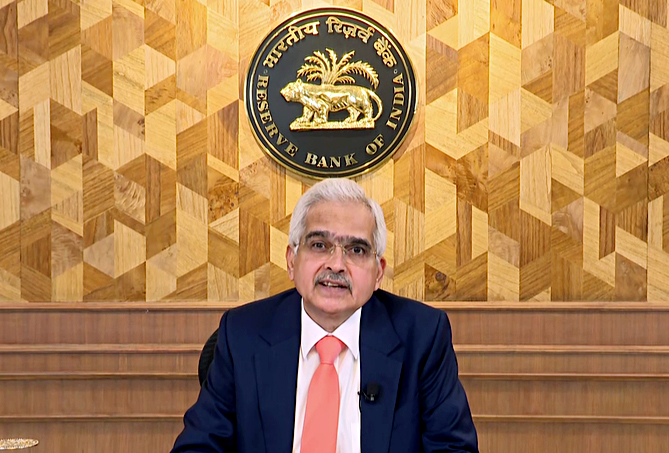

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday cautioned that heavy reliance on artificial intelligence (AI) could lead to concentration risks in the financial sector.

Speaking at the 90th High-Level Conference organized by the RBI in New Delhi, Governor Das expressed concern that the growing use of AI could enable a few technology providers to dominate the market, creating systemic vulnerabilities.

“The heavy reliance on AI can lead to concentration risks, especially when a small number of tech providers dominate the market,” said Governor Das.

He also pointed out that AI introduces new vulnerabilities, including increased susceptibility to cyberattacks and data breaches. The opacity of AI systems further complicates matters, making it difficult to audit or interpret the algorithms driving financial decisions.

Governor Das emphasized the importance of banks and financial institutions implementing strong risk mitigation strategies to address these risks. He underscored that while AI and Big Tech offer significant advantages, financial institutions must ensure they do not become overly dependent on these technologies.

Das urged financial institutions to remain vigilant, highlighting the need for a balanced approach in leveraging AI’s potential while addressing its inherent risks.

The RBI Governor’s remarks come at a time when AI and machine learning are increasingly being integrated into financial services, enhancing efficiency but also raising concerns about cybersecurity, transparency, and regulatory oversight.

With the rapid advancements in technology, the RBI is focused on ensuring that the financial sector remains resilient to both traditional risks and the emerging risks posed by AI and Big Tech.

(ANI)