In a move aimed at improving customer experience and safeguarding citizens, the Lok Sabha passed the Banking Laws (Amendment) Bill, 2024, on Tuesday.

The bill introduces several key reforms, including provisions for bank account holders to nominate up to four individuals for their accounts, which is expected to reduce the issue of unclaimed deposits.

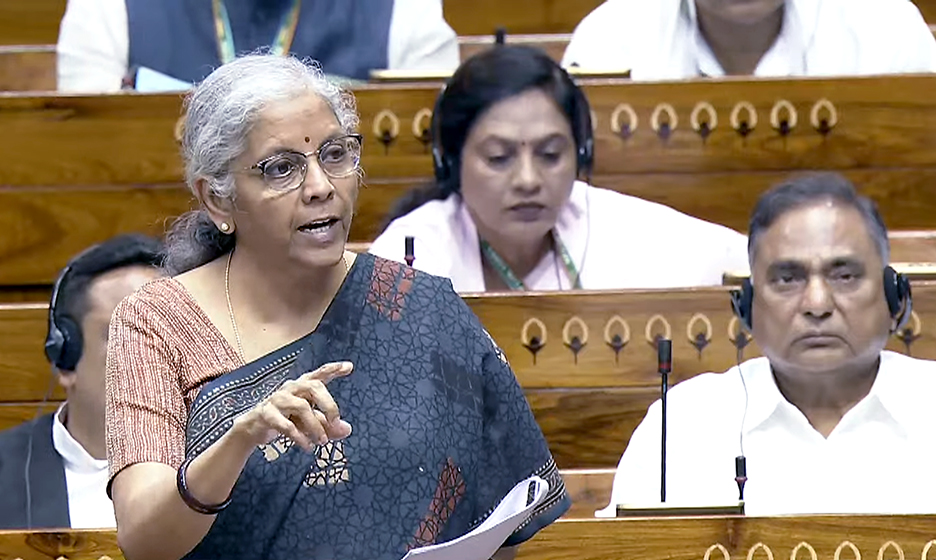

Finance Minister Nirmala Sitharaman said that depositors will be able to choose between successive or simultaneous nominations, while locker holders will be restricted to successive nominations only.

Another significant change is the redefinition of ‘substantial interest’ for directorships. The threshold will increase from the current Rs 5 lakh, which was set nearly six decades ago, to Rs 2 crore.

“India’s banking sector is critical to the nation. We can’t let even one bank struggle. Since 2014, we have been extremely cautious that banks remain stable. Our intention is to keep our banks safe, stable and healthy, and in 10 years everyone is seeing the outcome which in turn is benefiting the economy,” Sitharaman said during the debate.

“Banks are being professionally run today. The metrics are healthy so they can go to the market and raise bonds, raise loans and run their business accordingly,” she added.

Other provisions of the bill include aligning the reporting dates for statutory submissions by banks to the Reserve Bank of India (RBI) with the end of the fortnight, month, or quarter; extending the tenure of Directors (excluding the Chairman and whole-time Directors) in cooperative banks from 8 to 10 years; permitting a Director of a central cooperative bank to serve on the board of a state cooperative bank; and providing greater autonomy to banks in determining remuneration for statutory auditors.

(With inputs from agencies)