India’s retail inflation, based on the Consumer Price Index (CPI), is expected to ease to 5.5 percent in November due to a decline in food prices, according to a Morgan Stanley report.

“We expect CPI inflation to edge downwards to 5.5 percent in November from 6.2 percent in October, aided by a moderation in food prices, even as core inflation ticks up and fuel prices continue to decline. On a sequential basis, we anticipate the index to decline due to contracting food prices and a deceleration in core CPI,” the report said.

The core CPI includes goods and services but excludes food and fuel, the prices of which are considered more volatile.

CPI inflation reached 6.21 percent in October as higher prices of food items, such as vegetables, spiked during the month. This was the first time that inflation breached the RBI’s upper limit of 6 percent in recent months.

Retail inflation increased from 5.49 percent recorded in September as vegetable prices surged by as much as 42.18 percent in October. The late withdrawal of the monsoon this year resulted in damage to crops and reduced supply in the market.

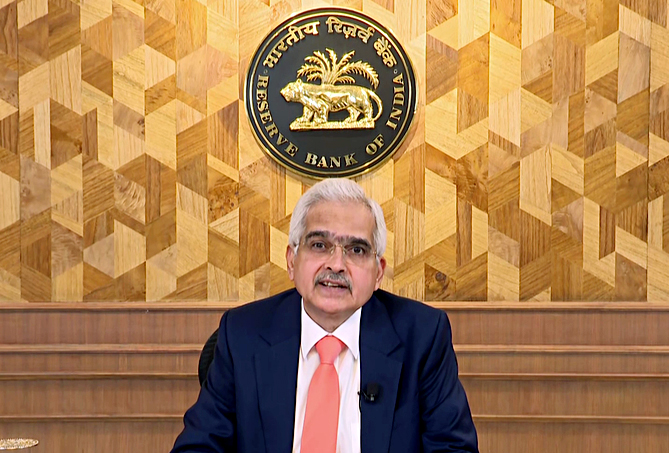

Despite the surge in inflation in October, outgoing RBI Governor Shaktikanta Das stressed last week that “India’s growth story remains intact.”

He highlighted that “the balance between inflation and growth is well poised.” However, Das warned of “significant risks in the outlook that cannot be underestimated.”

On Friday, the Reserve Bank of India (RBI) slashed the cash reserve ratio (CRR) for banks by 0.5 percent to make more funds available for lending to spur economic growth. However, it kept the key policy repo rate unchanged at 6.5 percent, with an eye on inflation.

The CRR cut will infuse Rs 1.16 lakh crore into the banking system and help bring down market interest rates.

(IANS)