NITI Aayog releases third edition of ‘Trade Watch Quarterly,’ highlights India’s trade resilience and impact of US trade policy

India’s trade performance in the third quarter of FY 2024–25 demonstrated cautious resilience amid rising geopolitical tensions and fluctuating global demand, according to the latest edition of Trade Watch Quarterly released by NITI Aayog on Monday.

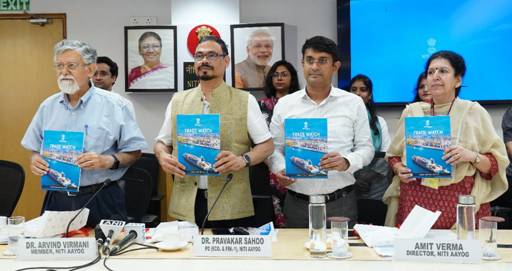

The third edition of the quarterly report, unveiled by NITI Aayog Member Dr. Arvind Virmani, presents a data-driven analysis of India’s trade performance during a period of international uncertainty and policy realignments.

According to the report, India’s merchandise exports grew 3% year-on-year in Q3, reaching $108.7 billion. Imports, however, rose by a sharper 6.5% to $187.5 billion, widening the merchandise trade deficit. Despite this gap, robust growth in the services sector played a balancing role.

Services exports surged by 17% during the quarter, generating a surplus of $52.3 billion.

The report highlights stability in export composition, with notable gains in specialized sectors. Aircraft, spacecraft, and related parts broke into the top ten export categories for the first time, posting a year-on-year growth of over 200%.

Regionally, North America and the European Union continued to dominate India’s export destinations, together accounting for nearly 40% of outbound shipments.

India’s prowess in the digital space was also reinforced, with the country ranking as the world’s fifth-largest exporter of Digitally Delivered Services (DDS), accounting for $269 billion in 2024.

Furthermore, high-tech merchandise exports, led by electrical machinery and arms/ammunition, have sustained robust momentum since 2014, growing at a compound annual growth rate of 10.6%.

This quarter’s thematic focus analyzes the impact of evolving US trade policy, particularly shifts in tariffs. The report identifies India’s relative tariff advantage over key competitors as a strategic window to expand its footprint in the American market.

Sectors such as pharmaceuticals, textiles, and electrical machinery are especially well-positioned to capitalize on these changes. The report stresses that timely and adaptive policymaking will be crucial in leveraging these changes to enhance India’s export competitiveness.