Thanks to the demographic dividend, with 65% of India’s population being under 35 years of age, and India being the largest provider of human resources in the world, with the largest pool of STEM graduates (STEM: Science, Technology, Engineering, and Mathematics) (according to an EY study), the country continues to remain the largest recipient of inward remittances — a trend maintained since 2008, according to the World Bank. In 2001, India’s share in the world’s total remittances was 11%. That increased to 14% in 2024. According to the Reserve Bank of India, the country is projected to receive remittances worth $160 billion by 2029.

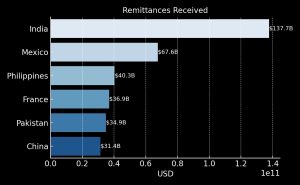

During the calendar year 2024, India received $137.7 billion in inward remittances, according to the Reserve Bank of India. That is more than double the remittances received by the next-highest country, Mexico, according to the World Bank’s country-wise remittances data for the year 2024. Also, India is the first country in the world to reach and cross the $100 billion mark in receiving remittances.

According to the RBI, of all migrants globally in 2024, India’s share was 6%. International migrants from India rose to 18.5 million in 2024 from 6.6 million in 1990. An EY assessment says India’s working-age population, among the major economies, will be the highest in the world — at 68.9% of its total population. The country, then, will have 1.04 billion working-age people, including international migrants, with India as the leading supplier of labour to the world. The following chart, with data taken from the World Bank, should be seen as a testimony to India’s rising power in supplying skilled manpower to the world across various industrial and services sectors.

The inward remittances are either part of the salary or come from the earnings that Indian migrant workers and the diaspora send to India — to their families and extended families. Unlike in the past, they are no longer limited to particular countries or geographies outside India. Remittances to India now come from Gulf countries as well as from advanced economies. According to the RBI Remittances Survey 2025, over half of India’s remittances in FY24 came from advanced economies such as the United States, United Kingdom, Singapore, Canada, and Australia. For that fiscal year, the United States emerged as the largest source (27.7% of total remittances in FY24), followed by the United Arab Emirates (19.2%).

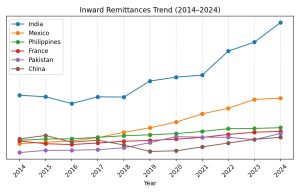

Also, as the World Bank dataset indicates, India’s inward remittances have doubled in the last 10 years — from $70 billion in 2014 to nearly $140 billion in 2024. Countries such as Mexico and Pakistan also saw significant growth during this period. The growth in inward remittances to India has shown a consistent increase since 2016. During the COVID crisis, it remained almost flat for a year, with a minor dip from $83.33 billion in 2019 to $83.15 billion in 2020, but has been increasing rapidly since then. If we analyse the historical trend, India has seen a positive and higher growth trajectory in inward remittances over the last two decades.

These massive numbers also reflect the strength and resilience of the Indian economy. For some nations, remittances constitute a lifeline, making up a huge portion of their economic activity. In Tonga, for instance, these inflows account for an astonishing 50% of GDP; in Tajikistan (47.9% of GDP), Lebanon (33.3%), and Nepal (33.1%) as well. Countries like Pakistan, with its economy in crisis, are significantly dependent on inward remittances to maintain their foreign exchange reserves. The country’s economy was $373 billion in current USD terms in 2024, according to the International Monetary Fund (IMF). That means remittances received were worth 9.36% of Pakistan’s GDP in 2024.

Pakistan had foreign exchange reserves of just $14.46 billion during the week ending 18th July 2025, according to data from the State Bank of Pakistan (SBP). According to a report by Dawn, a Pakistani newspaper, when, in January 2023, Pakistan’s foreign exchange reserves fell to $4.3 billion, it was just enough to cover three weeks of the country’s imports. If we replicate that to the current foreign exchange reserves, it can cover just 10 weeks of imports. Increasing inward remittances come as a saving grace, serving as a rescue measure for the country.

India’s situation is fundamentally different. The $137.7 billion in remittances represents just 3.3% of India’s multi-trillion-dollar GDP, which the IMF currently values at $4.19 trillion. With around $700 billion in foreign exchange reserves, and projections indicating that it will soon become the world’s third-largest economy, the country is not dependent on remittances — but is fortified by these receipts. They serve as another positive sign: a stable and growing income source within the external financing of a large economy — one that is also the world’s fastest-growing, and expected to remain so in the years ahead.