As the Pradhan Mantri Jan Dhan Yojana (PMJDY) completes a decade, a large number of account holders are now due for re-KYC (Know Your Customer) updates, the Reserve Bank of India said on Wednesday.

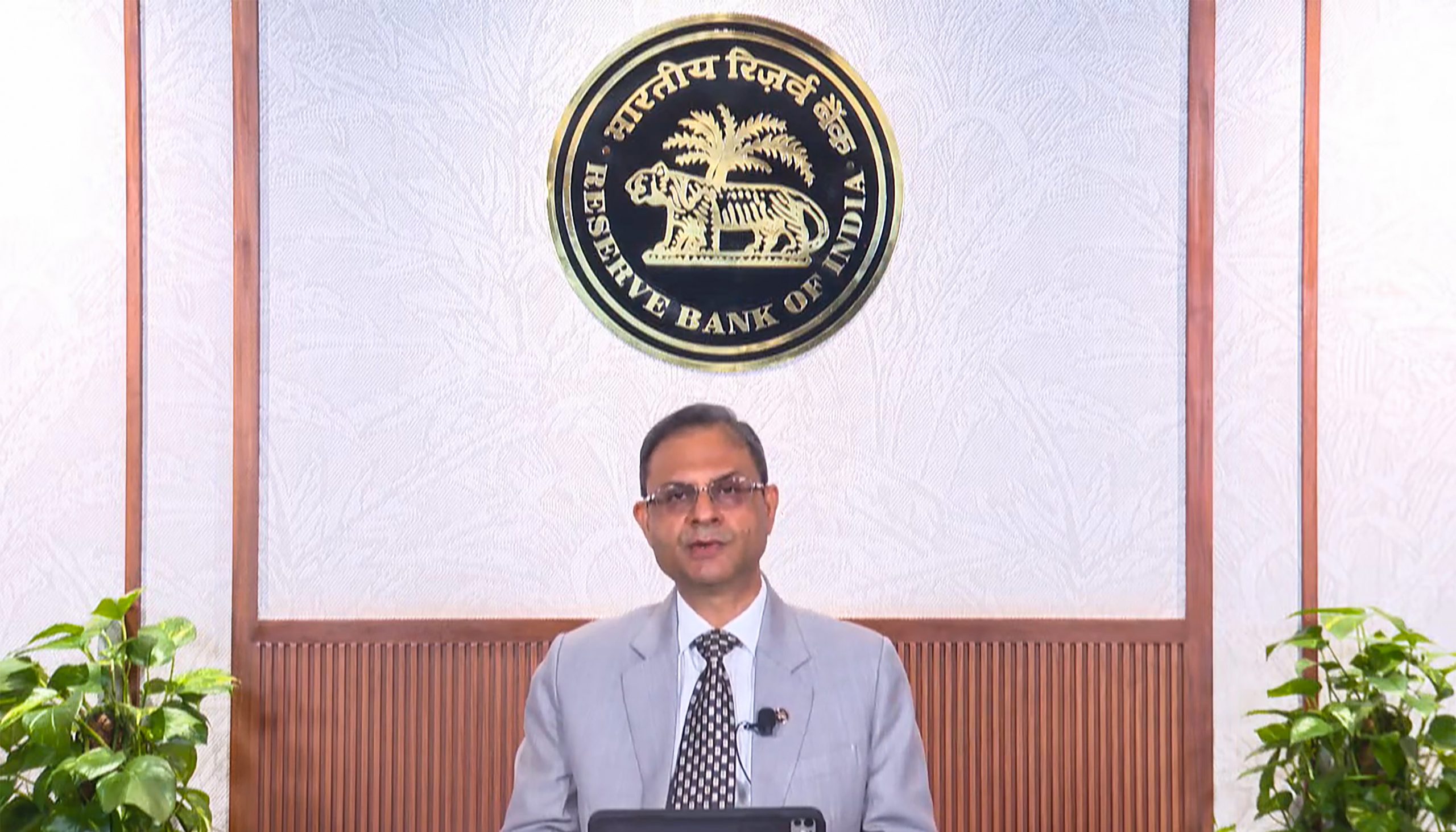

RBI Governor Sanjay Malhotra, in his Monetary Policy Committee (MPC) statement, said public sector banks have started organising re-KYC camps at the panchayat level across the country from July 1 to September 30.

“The banks are organising camps at the Panchayat level in an endeavour to provide services at customer doorsteps. Apart from opening new bank accounts and re-KYC, the camps will focus on micro-insurance, pension schemes, and grievance redress,” Malhotra said.

Re-KYC is a process for updating customer records with current personal and address details. It ensures continued access to banking services and compliance with regulatory requirements.

The RBI also introduced a policy on the settlement of claims related to bank accounts, articles in safe custody, and contents of safe deposit lockers of deceased customers. The move aims to simplify and expedite the claims process.

Launched in 2014, the Pradhan Mantri Jan Dhan Yojana is the government’s flagship financial inclusion programme. It offers access to basic savings and deposit accounts, remittance, credit, insurance, and pension services.

Under the scheme, individuals without existing bank accounts can open Basic Savings Bank Deposit (BSBD) accounts at bank branches or through Business Correspondents (Bank Mitras). PMJDY account holders receive a RuPay debit card with an inbuilt accident insurance cover of ₹2 lakh.

According to the Prime Minister’s Office, over 55.90 crore accounts have been opened under the PMJDY so far. “Pradhan Mantri Jan Dhan Yojana has transformed access to financial services for the poorest. It has bridged the gap between banks and the unbanked, promoting dignity, self-reliance and economic inclusion,” PMO India posted on X.

The government has also expanded related financial inclusion initiatives. As of now, 53.85 crore loans worth over ₹35.13 lakh crore have been sanctioned under the Pradhan Mantri MUDRA Yojana (PMMY), which offers collateral-free loans of up to ₹20 lakh to micro and small enterprises.

In addition to re-KYC, the ongoing panchayat-level camps are facilitating enrolments in key social security schemes, including the Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Atal Pension Yojana.

-IANS