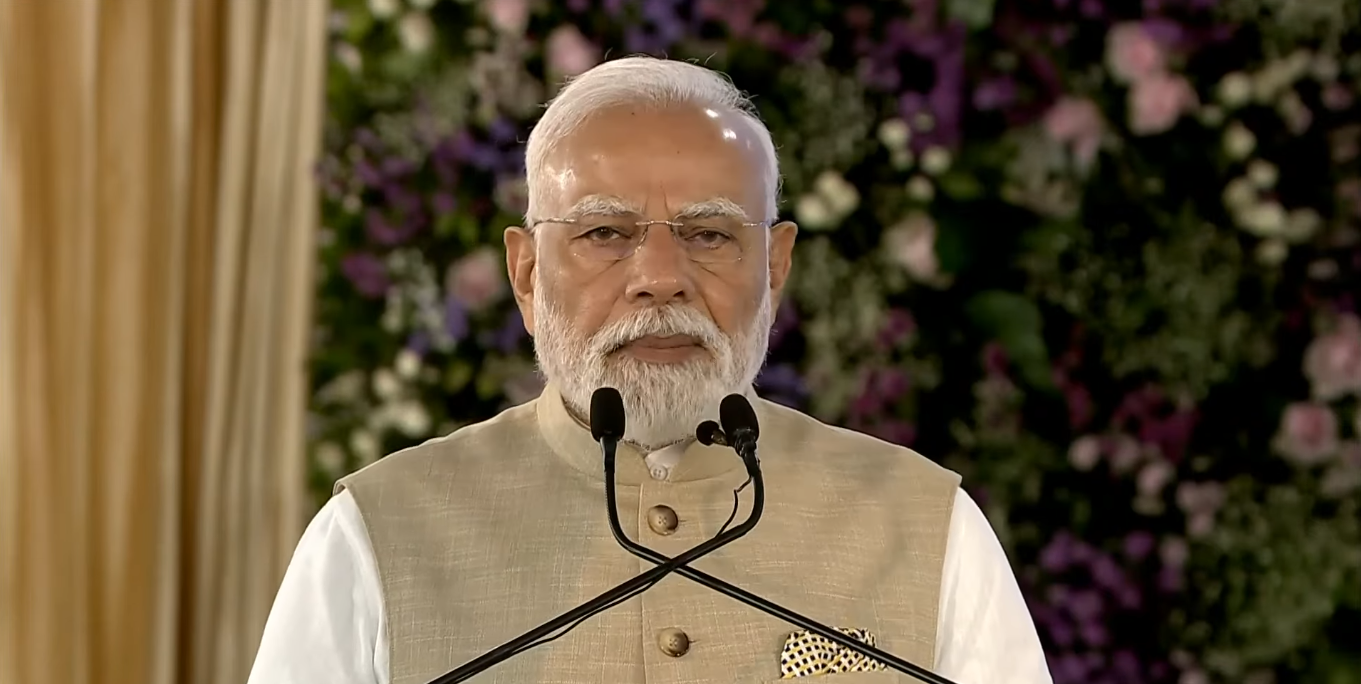

Prime Minister Narendra Modi on Friday said that the latest Goods and Services Tax (GST) reforms are not just technical adjustments but bold steps aimed at improving the ease of living, ease of doing business, and ease of investing in India.

“By lowering rates on everyday foods and packaging, these reforms make groceries more affordable, boost MSMEs, support farmers, and enhance India’s global food competitiveness,” PM Modi said in a post on X.

The Prime Minister was responding to an article written by Union Minister Chirag Paswan on GST 2.0, which comes into effect on September 22, just ahead of the festive season. The reforms are expected to reduce the prices of over 90 per cent of goods sold in markets across the country.

“In his Independence Day address, Prime Minister Modi committed to next-generation GST reforms by Diwali. From September 22, that promise will show up in grocery bills nationwide. This is the essence of these changes: it’s a relief you can taste,” said Chirag Paswan in his article.

Under the new structure, ultra-pasteurised milk, packaged paneer, and all common Indian breads will attract 0 per cent GST. Most processed foods, including biscuits, namkeens, breakfast cereals, and coffee, will be taxed at 5 per cent. The objective is to keep food affordable, ensure clear classification and rate certainty, and allow industries to focus on scale and quality.

The article highlights that the timing of these reforms is significant, coinciding with a historic expansion of India’s food sector, driven by rising incomes, urbanisation, and a young population seeking health- and convenience-oriented products.

For households, the impact will be immediate. A large share of everyday groceries will now fall under the 0 per cent or 5 per cent GST brackets, lowering monthly expenses without forcing families to compromise on hygiene or nutrition. The lower indirect tax burden leaves consumers with more disposable income each month, directly benefiting their recurring grocery budget.

As competition adjusts prices, consumers can expect greater choice in fortified, ready-to-cook, and ready-to-eat food options designed to suit modern lifestyles.

The article also notes that MSMEs and farmers stand to gain significantly. Food processing connects farmers’ incomes to the nation’s nutritional needs. Affordable processed foods boost year-round demand for milk, grains, fruits, and spices, reducing wastage and improving price realisation for farmers, Paswan added.

(With inputs from IANS)