Union Finance Minister Nirmala Sitharaman on Thursday said that while citizens across the country would benefit from the GST rate cuts, 11 Bengal-specific items had been brought under the 5 per cent tax slab to support the state’s economy and its people.

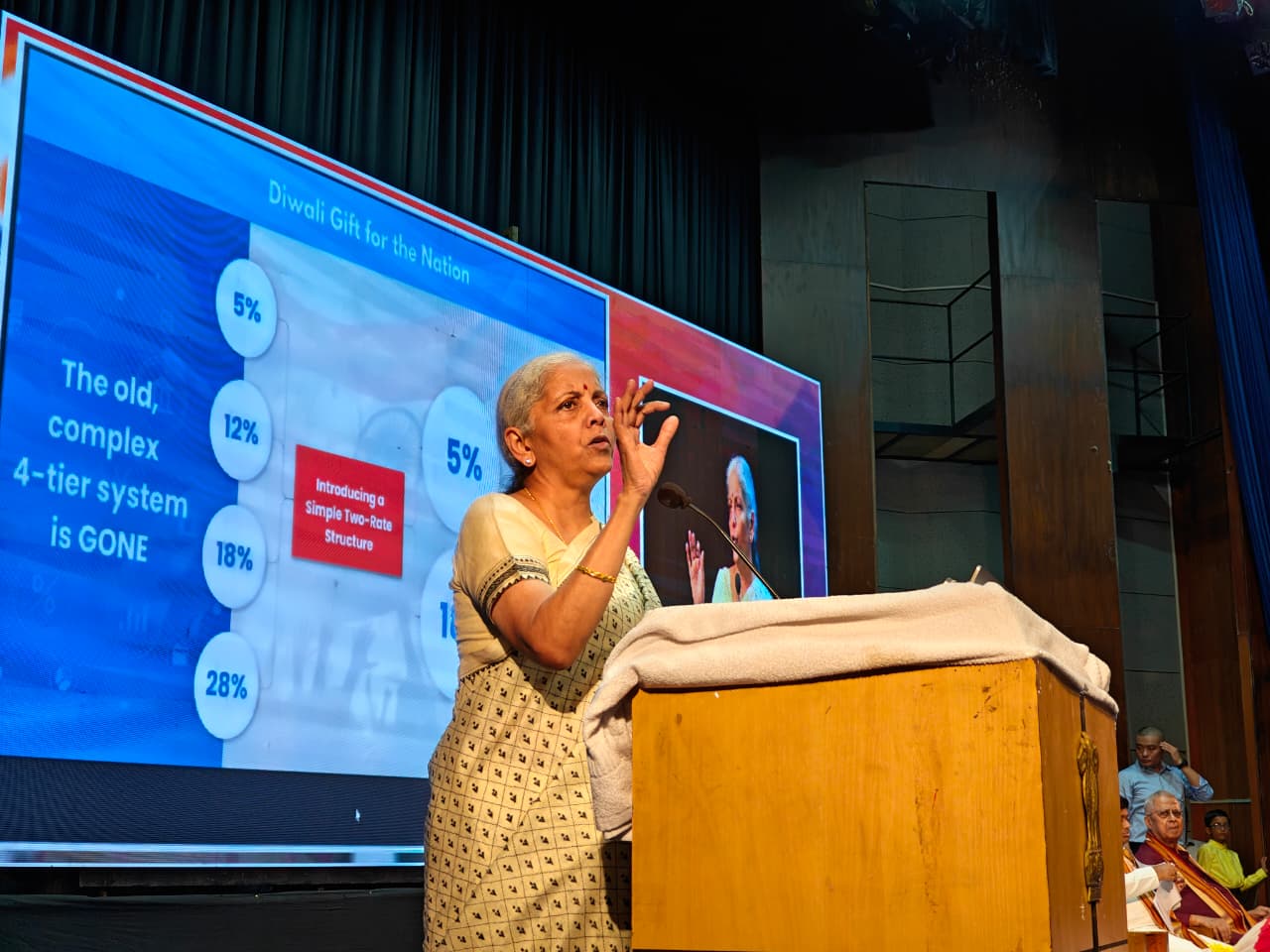

Addressing the GST 2.0 outreach programme in Kolkata, Sitharaman noted that the reforms, effective from September 22, were timed so that consumers could benefit ahead of Durga Puja.

GST on Shantiniketan leather goods has been reduced to 5 per cent, while Bankura terracotta craft will now also attract 5 per cent GST, which she said would boost demand for these products.

Similarly, the tax rate on Madhurkati matches, Purulia Chau masks, and wooden masks from Dinajpur has been cut to 5 per cent.

Other West Bengal products to benefit include processed mango items from Malda, Darjeeling tea, and jute bags—all of which will now fall under the 5 per cent slab. Sitharaman said this would benefit farmers, craftsmen, and manufacturers by making the products more affordable and increasing demand.

“These rates were not fixed randomly but aimed at helping the middle class, the poor, and farmers,” she said.

The GST 2.0 reforms, she added, would also support the MSME sector, spur economic growth, and create more jobs.

Sitharaman further said the GST Council, a constitutional body, had the consensus of opposition-ruled states, including West Bengal, on reducing slabs and cutting GST rates for health schemes.

“States came together and agreed to the proposal. I even wrote personal letters to all state finance ministers,” she said.

Quoting Prime Minister Narendra Modi, she remarked that the government wanted a simpler GST tax system. “Bureaucrats deliver when leaders support the system,” she said, adding that the Finance Ministry has been consistently reviewing rules to advance tax reforms.

“No one imagined that the income tax rate on personal income would be slashed, but we made it happen,” Sitharaman said.

-IANS