India’s electronics sector reached a major milestone in 2024-25, with production touching ₹11.3 lakh crore, a six-fold increase from ₹1.9 lakh crore in 2014-15. This surge reflects a decade-long transformation of the sector, driven by domestic policy support, rapid capacity expansion, and growing integration with global value chains. The journey has created over 25 lakh jobs, making electronics one of India’s most dynamic and employment-generating sectors.

The sector’s growth aligns with India’s broader vision to become a global manufacturing hub under Make in India and Atmanirbhar Bharat. With a target of building a $500 billion domestic electronics ecosystem by 2030-31, India is now firmly on track to become a global leader in electronics design, manufacturing, and exports.

India’s electronics industry has undergone a structural evolution in the last decade, supported by enabling policies, improved ease of doing business, and rising investor confidence. Between 2014–15 and 2024-25, production increased nearly six times, while exports jumped from ₹38,000 crore to ₹3.27 lakh crore, an eight-fold rise. The growth is not just in volume but also in the strategic nature of India’s role in the global electronics supply chain. Since FY 2020-21, India has attracted over USD 4 billion in foreign direct investment (FDI) in electronics manufacturing. Nearly 70 percent of this FDI comes from companies participating in India’s flagship Production Linked Incentive (PLI) Scheme.

Indian electronics goods are now exported to major markets, with the top five destinations in FY 2024-25 being the United States, United Arab Emirates, Netherlands, the United Kingdom, and Italy.

Mobile phones have emerged as the centerpiece of India’s electronics growth story. The transformation has been both quantitative and qualitative. In 2014-15, India produced just ₹18,000 crore worth of mobile phones. By 2024-25, this number reached ₹5.45 lakh crore a 28-fold rise. India has now become the second-largest mobile phone manufacturer in the world, producing approximately 330 million devices annually. What makes this journey even more significant is the reversal in India’s import dependence from importing 78% of mobile devices in 2014-15 to near self-reliance today.

Exports have also seen unprecedented growth. From just ₹1,500 crore in 2014-15, mobile phone exports reached ₹2 lakh crore in 2024-25, growing 127 times in a single decade. A large share of this success can be attributed to the scale-up of global manufacturing in India. In 2024, Apple exported ₹1,10,989 crore worth of iPhones from India, growing 42% year-on-year.

India’s performance in FY 2025-26 has continued on a high note. In the first five months of the financial year alone, smartphone exports crossed ₹1 lakh crore, marking a 55% increase over the same period last year. Notably, India overtook China in Q2 FY 2025-26 to become the top smartphone exporter to the United States , signalling a shift in global trade dynamics. From just two mobile phone units in 2014, India now has over 300 manufacturing facilities, supporting both domestic demand and global exports. This expansion has contributed significantly to job creation across tier-2 and tier-3 cities.

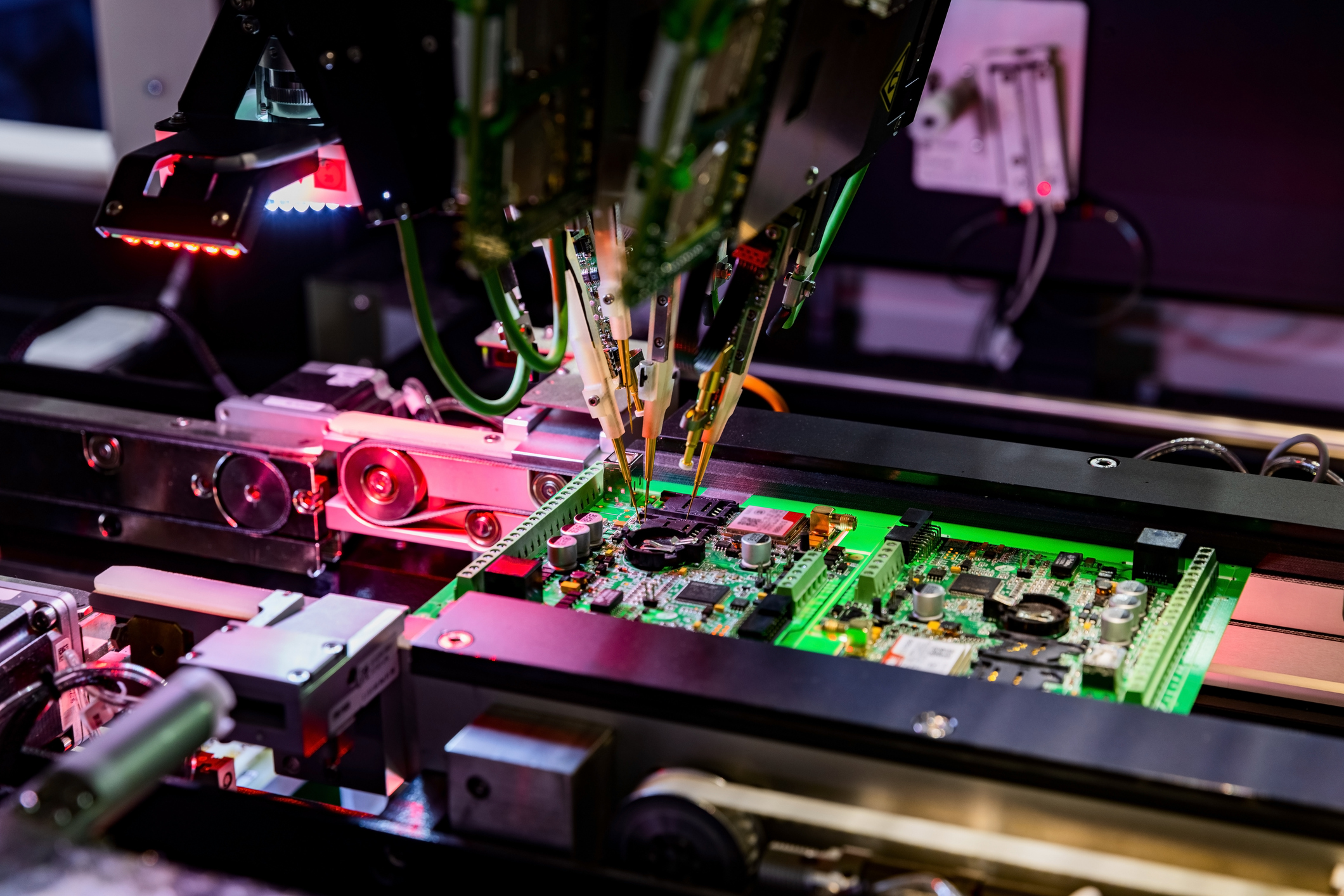

Beyond mobile phones, electronics are now integral to every sector of the economy. Whether in homes, hospitals, factories, or vehicles, electronics are enabling innovation, improving efficiency, and enhancing quality of life. In consumer electronics, widespread access to televisions, refrigerators, washing machines, and air conditioners reflects rising affordability and a growing domestic market. In electronic components, India is working to reduce its import dependence by strengthening local supply chains. Components form the backbone of all electronic devices, and this sub-sector is critical to long-term industrial resilience.

Automotive electronics have become essential as the world shifts to electric and connected mobility. From sensors and infotainment systems to vehicle control units, electronics now power next-generation transport solutions. In medical electronics, India is seeing growing use of devices such as oximeters, glucometers, and patient monitors. These technologies are enhancing healthcare delivery, expanding access, and improving diagnostic accuracy.

India’s electronics growth has been underpinned by proactive government policies and dedicated schemes designed to enhance competitiveness and attract investment.

The Production Linked Incentive (PLI) Scheme, launched with an outlay of ₹1.97 lakh crore across 14 sectors, has been instrumental in scaling up large-scale electronics manufacturing. As of June 2025, investments worth ₹13,107 crore have been mobilized, production generated stands at ₹8.56 lakh crore, exports touched ₹4.65 lakh crore, and over 1.35 lakh direct jobs have been created. The scheme has had a strong multiplier effect, attracting global supply chains to India and supporting MSMEs and OEMs alike.

The Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) provides 25% financial incentives on capital expenditure for units manufacturing electronic components and semiconductors. This is helping to bridge key supply chain gaps and facilitate a shift from assembly-based manufacturing to end-to-end electronics production.

The Electronics Components Manufacturing Scheme (ECMS), approved by the Cabinet in May 2025, is emerging as a cornerstone of India’s electronics manufacturing roadmap. With a budget outlay of ₹22,919 crore, the scheme received 249 applications in its initial phase. Key projections include investment proposals worth ₹1.15 lakh crore almost double the target, production worth ₹10.34 lakh crore expected over six years 2.2 times the original estimate, and creation of 1.42 lakh direct jobs, exceeding the target of 91,600. The application window, originally for three months, was extended to 30 September 2025 due to overwhelming industry response. ECMS is expected to play a crucial role in achieving the $500 billion electronics manufacturing target by 2030-31.

The National Policy on Electronics (NPE) 2019 provides the strategic framework to position India as a global hub for Electronics System Design and Manufacturing (ESDM). It aims to generate $400 billion in ESDM revenues by 2025, with a focus on design-led innovation and R&D intensive growth.

India’s electronics sector stands today not just as a story of manufacturing growth, but as a strategic pillar of the country’s broader economic transformation. The creation of 25 lakh jobs, the steep rise in exports, the shift to self-reliance in mobile manufacturing, and the integration with global value chains mark a fundamental repositioning of India in the global technology economy.

With the continued rollout of schemes like PLI, ECMS, and SPECS, and a clear vision articulated under the National Policy on Electronics, India is laying the foundation for a resilient, high-value, and innovation-driven electronics ecosystem. As the country marches towards its goal of a $500 billion electronics manufacturing base by 2030-31, the sector is set to drive not only economic growth and exports, but also digital empowerment, industrial modernization, and global competitiveness.

(PIB)