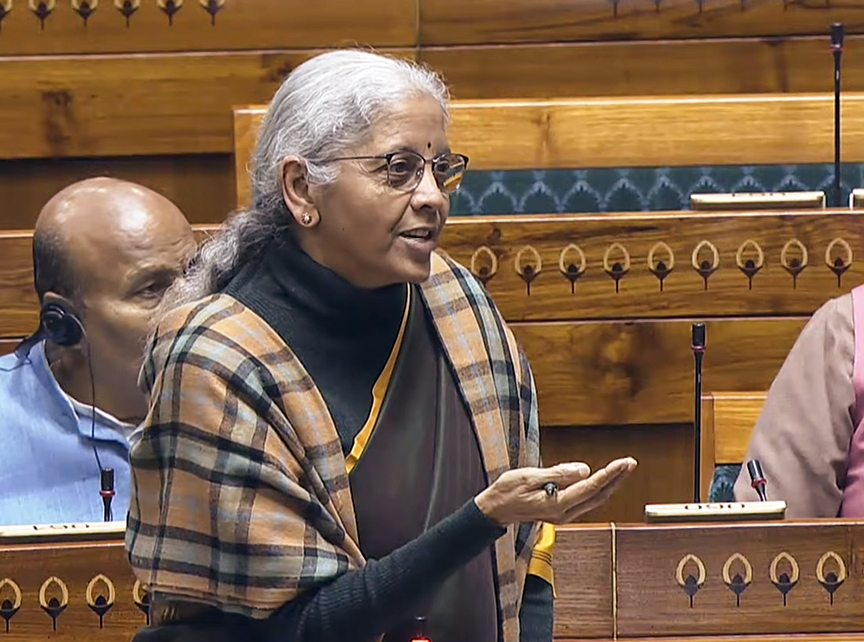

Finance Minister Nirmala Sitharaman on Thursday introduced the Securities Markets Code Bill, 2025 in the Lok Sabha, aimed at consolidating and replacing three existing securities laws with a single, modern framework.

The proposed legislation seeks to repeal and subsume the SEBI Act, 1992, the Depositories Act, 1996, and the Securities Contracts (Regulation) Act, 1956, providing a unified statutory structure for investor protection and capital mobilisation.

According to an official statement, the Bill marks a major milestone, as a comprehensive review of securities market legislation is being undertaken for the first time. The move is expected to facilitate wider investor participation and enhance capital mobilisation in line with the needs of India’s fast-growing economy.

The government noted that the existing securities law regime consists of three separate Acts enacted decades ago, many of which contain overlapping and redundant provisions. The Securities Markets Code (SMC), 2025 seeks to consolidate and rationalise these laws into a principle-based legislative framework aimed at reducing compliance burden, improving regulatory governance and enhancing the dynamism of technology-driven securities markets.

The language of the Code has been simplified to remove duplication, omit redundant concepts and introduce consistent regulatory procedures, ensuring a uniform and streamlined securities law framework.

The Bill proposes to strengthen the regulatory mechanism of the Securities and Exchange Board of India (SEBI) by expanding its board from the current nine members to up to 15 members, including the Chairperson. It also introduces a transparent and consultative process for issuing subordinate legislation.

To address potential conflicts of interest, the Code mandates disclosure of any direct or indirect interests by board members during decision-making.

The legislation also streamlines enforcement procedures by introducing a single adjudication process for all quasi-judicial actions, following a structured fact-finding exercise. It maintains an arm’s-length separation between investigation and adjudication, and lays down timelines for investigations and interim orders to ensure time-bound regulatory action, providing greater clarity and certainty to market participants.

As a significant reform measure, the Code decriminalises certain minor, procedural and technical contraventions by converting them into civil penalties, with the objective of improving ease of doing business and reducing compliance burden. Criminal provisions are retained only for cases involving market abuse, non-compliance with quasi-judicial orders, and non-cooperation during investigations.

The Bill also seeks to strengthen investor protection through enhanced investor education, awareness initiatives and a time-bound grievance redressal mechanism. It provides for the establishment of an Ombudsperson to address investor complaints.

In addition, the Code empowers SEBI to set up a Regulatory Sandbox to encourage innovation in financial products, contracts and services. It also establishes an enabling framework for inter-regulatory coordination to facilitate seamless listing of regulated instruments.

Overall, the proposed legislation aims to further strengthen SEBI, promote efficient and transparent securities markets, improve regulatory governance and enhance investor confidence, the statement said.

— IANS