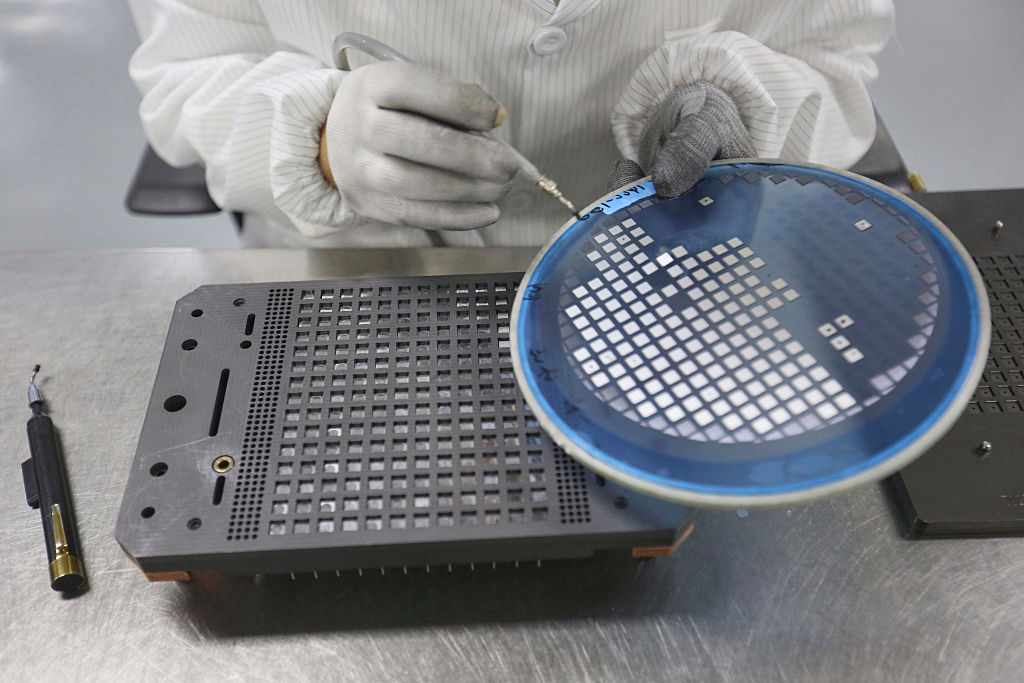

The Union Budget 2026-27 has unveiled a series of measures aimed at accelerating growth in India’s electronics and information technology sectors, including the launch of India Semiconductor Mission (ISM) 2.0, an enhanced outlay for electronics manufacturing, and tax reforms to provide greater certainty to the IT and ITeS industry.

Presenting the Budget in Parliament on Sunday, Finance Minister Nirmala Sitharaman announced that ISM 2.0 will focus on producing semiconductor equipment and materials, designing full-stack Indian intellectual property, and strengthening supply chains. The initiative will emphasise industry-led research and training centres to build advanced technologies and a skilled workforce. An allocation of ₹1,000 crore has been provided for ISM 2.0 in FY 2026–27, building on the progress made under ISM 1.0.

To capitalise on strong investor interest in electronics manufacturing, the Budget proposes to increase the outlay for the Electronics Components Manufacturing Scheme (ECMS) to ₹40,000 crore. The scheme, launched in April 2025, has already attracted investment commitments at more than double its initial target.

In a significant move to support India’s IT sector and provide tax certainty, the Budget introduces new safe harbour provisions for IT and ITeS services with higher thresholds and competitive margins.

Under the proposal, software development services, IT-enabled services, knowledge process outsourcing and contract R&D services will be clubbed under a single category of ‘Information Technology Services’, with a common safe harbour margin of 15.5 per cent.

The threshold for availing safe harbour has been raised sharply from ₹300 crore to ₹2,000 crore. The safe harbour approval process will be fully automated and rule-driven, eliminating the need for tax officer scrutiny. Once opted for, the safe harbour can be continued for five consecutive years at the company’s discretion.

For companies opting for Advance Pricing Agreements (APA), the Budget proposes to fast-track the Unilateral APA process for IT services, with an endeavour to conclude cases within two years, extendable by six months on request. The facility of modified returns for entities entering into APAs will also be extended to their associated enterprises.

Recognising the importance of data centres as critical digital infrastructure, the Budget proposes a tax holiday till 2047 for foreign companies providing global cloud services using data centre infrastructure located in India. Such companies will be required to serve Indian customers through an Indian reseller entity.

In cases where data centre services are provided by a related entity in India, a safe harbour margin of 15 per cent on cost has also been proposed.

The Budget also proposes the establishment of a High-Powered ‘Education to Employment and Enterprise’ Standing Committee to recommend measures for strengthening the services sector as a core driver of Viksit Bharat. The committee will assess the impact of emerging technologies, including artificial intelligence, on jobs and skill requirements and suggest appropriate policy interventions.