The Union Budget 2026-27 has reaffirmed the capital goods sector as a central pillar of India’s industrial and infrastructure strategy, with a strong emphasis on public capital expenditure, high-precision manufacturing, and long-term capacity creation. Backed by sustained government investment and targeted policy support, the sector is poised to play a critical role in accelerating economic growth and strengthening India’s global manufacturing competitiveness.

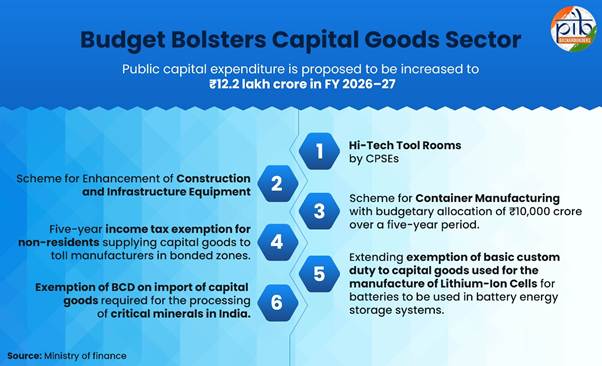

Over the past decade, government capital outlay has expanded sharply, rising 4.2 times from ₹2.63 lakh crore in FY18 to ₹11.21 lakh crore in FY26 (Budget Estimates). The Budget for FY 2026–27 takes this momentum further, proposing public capital expenditure of ₹12.2 lakh crore, underlining the government’s continued focus on infrastructure-led growth and crowding in private investment.

Capital Goods: Driving Industrial and Infrastructure Expansion

The capital goods sector—comprising machinery, equipment and accessories required for manufacturing and services—forms the backbone of industrial development. It supports capacity creation across sectors ranging from manufacturing and mining to agriculture, logistics and services, while also enabling modernisation and technological upgradation.

Recognising its multiplier effect on growth and employment, the government has consistently prioritised the sector through regulatory reforms, fiscal incentives and large-scale infrastructure spending. The Union Budget 2026–27 builds on this approach, aligning capital goods development with the broader objective of accelerating and sustaining economic growth under the framework of the government’s three kartavyas.

Strong Industrial Momentum

Recent data point to robust performance in the capital goods segment. The Index of Industrial Production (IIP) recorded a growth of 7.8 per cent in December 2025, supported by an 8.1 per cent expansion in manufacturing. Capital goods under the use-based classification also grew 8.1 per cent year-on-year during the same period, reflecting healthy investment demand.

The Economic Survey 2025–26 notes that manufacturing growth became more broad-based in FY26, with Gross Value Added (GVA) growth accelerating to 7.72 per cent in Q1 and 9.13 per cent in Q2. High-frequency indicators further signal firming investment momentum, with capital goods imports rising from 6.6 per cent in Q1 FY26 to 13.4 per cent in Q3 FY26, alongside capacity utilisation levels remaining above long-term averages.

Exports of capital goods have also shown steady growth, increasing to ₹33,356 crore in FY25 from ₹31,621 crore in FY24, while production rose to over ₹2.05 lakh crore during the same period. At the same time, rising imports of technologically advanced machinery underline both resilient domestic demand and the need to strengthen local manufacturing capabilities.

Budget Push for Infrastructure and Manufacturing

The Union Budget 2026–27 underscores the role of capital goods in supporting infrastructure creation and industrial transformation. Public capital expenditure is proposed to rise by around 9 per cent over FY 2025–26 (BE), reinforcing investment in roads, railways, energy, logistics and urban infrastructure.

To enhance domestic manufacturing capabilities, the Budget announces several targeted initiatives. Hi-Tech Tool Rooms are proposed to be set up by Central Public Sector Enterprises at two locations, functioning as digitally enabled service hubs for the design, testing and manufacture of high-precision components. A new Scheme for Enhancement of Construction and Infrastructure Equipment (CIE) has also been proposed to strengthen indigenous production of technologically advanced equipment such as tunnel-boring machines, lifts, fire-fighting equipment and machinery for high-altitude infrastructure projects.

In a major boost to logistics and trade infrastructure, the Budget introduces a ₹10,000 crore Container Manufacturing Scheme over five years, aimed at creating a globally competitive container manufacturing ecosystem in India.

Tax Incentives and Customs Duty Relief

To reduce capital costs and attract global players, the Budget proposes five-year income tax exemptions for non-resident entities supplying capital goods, equipment or tooling to toll manufacturers operating in bonded zones. Similar incentives have been extended to toll manufacturers engaged in electronics manufacturing, with tax exemptions proposed up to FY 2030–31.

In support of energy transition and critical minerals processing, the government has proposed extending basic customs duty exemptions on capital goods used for manufacturing lithium-ion cells for battery energy storage systems. Capital goods required for processing critical minerals in India are also proposed to be exempted from basic customs duty, strengthening domestic value chains in strategic sectors.

Policy Continuity Through PLI and Competitiveness Schemes

The Budget builds on the gains achieved through Production Linked Incentive (PLI) schemes, which have attracted over ₹2 lakh crore in investments till September 2025, generated incremental production exceeding ₹18.7 lakh crore, and created over 12.6 lakh jobs. Key PLI schemes such as PLI-Auto and PLI-Advanced Chemistry Cell have played a significant role in boosting demand for capital goods.

Additionally, the Scheme for Enhancement of Competitiveness in the Indian Capital Goods Sector continues to strengthen industry–academia collaboration. Under Phase II of the scheme, 29 projects with a total cost of ₹891.37 crore have been approved as of November 2025, with technologies developed under the programme finding markets in countries such as France, Belgium and Qatar.

A Strong Foundation for Long-Term Growth

With sustained public investment, targeted manufacturing incentives and focused policy support, the Union Budget 2026–27 positions the capital goods sector as a key enabler of India’s investment-led growth strategy. As infrastructure expansion, energy transition and manufacturing modernisation gather pace, the sector is expected to play a decisive role in building industrial capacity, enhancing productivity and supporting India’s long-term economic momentum.