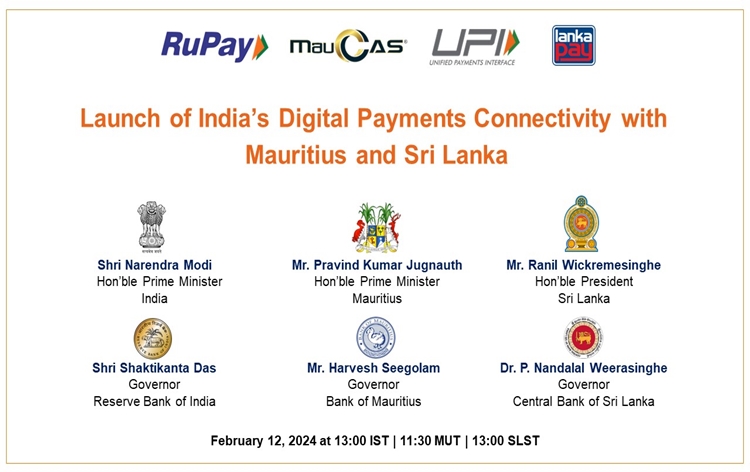

In a move aimed at enhancing digital connectivity and spurring financial innovation, Prime Minister Narendra Modi, Sri Lankan President Ranil Wickremesinghe, and Mauritius Prime Minister Pravind Jugnauth will jointly inaugurate Unified Payment Interface (UPI) services in Sri Lanka and Mauritius, along with the introduction of RuPay card services in Mauritius.

The inauguration ceremony, scheduled for Monday at 1 PM, will be conducted via video conferencing, as announced by the Ministry of External Affairs (MEA).

India’s stature as a fintech pioneer and its robust digital infrastructure position it as a key player in sharing developmental experiences and innovations with partner nations. Leveraging deep-rooted cultural ties and people-to-people connections with Sri Lanka and Mauritius, the introduction of UPI and RuPay services aims to streamline digital transactions, enhancing connectivity between the countries.

The rollout will facilitate UPI settlement services for Indian nationals traveling to Sri Lanka and Mauritius, as well as for Mauritian nationals visiting India. Additionally, the extension of RuPay card services in Mauritius will enable Mauritian banks to issue cards based on the RuPay mechanism, facilitating seamless transactions between India and Mauritius.

During Wickremesinghe’s visit to New Delhi in July 2023, India and Sri Lanka forged an agreement on the acceptance of UPI within the island nation.

Moreover, in February 2023, PhonePe, a prominent Indian digital payments and fintech firm, introduced cross-border UPI payments under UPI International. This feature allows users to utilize their Indian bank accounts for transactions at merchant outlets in the UAE, Singapore, Mauritius, Nepal, and Bhutan.

As India’s largest UPI app by market size, PhonePe achieved a significant milestone by integrating UPI International, facilitated by the cross-border arm of the National Payments Corporation of India (NPCI International Payments Limited).

Rahul Chari, CTO, and co-founder of PhonePe, expressed optimism, saying, “UPI International marks a significant step toward globalizing UPI. This launch is poised to be a game-changer, transforming the payment experience for Indians abroad.”

The UPI payment system, widely embraced for retail digital transactions in India, continues to gain traction. Serving as India’s mobile-based rapid payment system, UPI enables customers to conduct instant, round-the-clock payments using a virtual payment address (VPA) created by the user.

(Inputs from ANI)