The Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 6.5 percent for the sixth time in a row during its February meeting. The repo rate is the interest rate at which RBI lends money to other banks.

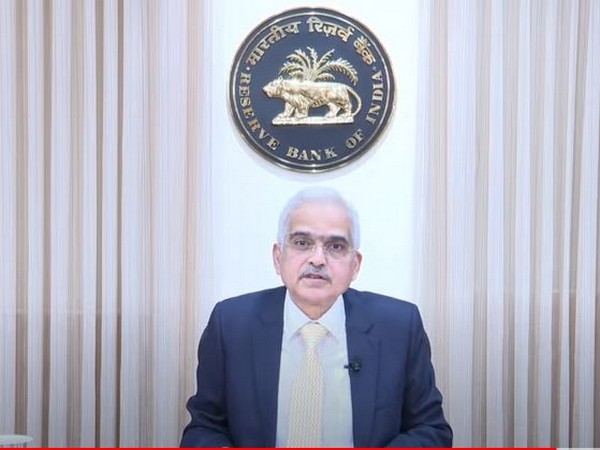

RBI Governor Shaktikanta Das mentioned that they kept the rate steady due to comfortable inflation levels and steady economic growth. While inflation is within RBI’s preferred range of 2-6 percent, it’s a bit higher than the ideal 4 percent target, standing at 5.69 percent in December.

The majority of the Monetary Policy Committee (MPC) members agreed to focus on gradually withdrawing economic support to help inflation align with the target while still supporting growth.

India’s economy grew by 7.6 percent in the July-September quarter, making it one of the fastest-growing major economies. The RBI holds meetings every two months to discuss interest rates, money supply, inflation, and other economic indicators.

The decision to keep the repo rate steady again might be due to expectations of further inflation decline. India has managed its inflation well compared to many other countries. Before these recent pauses, the RBI had increased the repo rate by 2.5 percent since May 2022 to tackle inflation. Increasing interest rates usually helps reduce demand in the economy, which can bring down inflation.