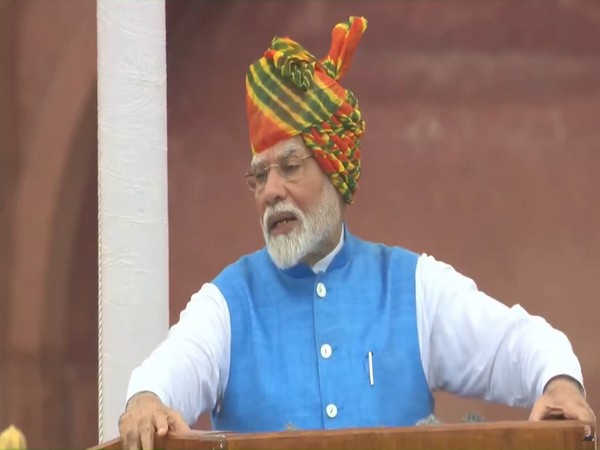

In his address marking the 78th Independence Day, Prime Minister Narendra Modi praised the reforms in India’s banking sector from the ramparts of the Red Fort. He emphasized that these reforms have significantly strengthened the country’s banking system, placing Indian banks among the strongest in the world.

“The banks were in trouble, we made several reforms and today our banks are counted among the strongest banks in the world. This increases the strength of the formal economy,” PM Modi said.

The Prime Minister highlighted that reforms implemented by a country establish a blueprint for growth. He asserted that the government’s path of reforms has become India’s roadmap for economic progress.

“The reforms serve as a kind of blueprint for our path to growth,” PM Modi said. He emphasized that the commitment to reform is not merely for editorials or praise, but for strengthening the nation. “We have brought big reforms on ground. For the poor, middle class, deprived… for the aspirations of our youth, we choose the path to bring reforms in their lives,” he added.

PM Modi also pointed out the positive impact of these reforms on various sectors of the economy. He noted that banks have provided great stability to the MSME sector, and small traders and hawkers have also benefited from these changes.

The Prime Minister’s remarks align with recent statements from the Reserve Bank of India (RBI). The central bank has highlighted the robustness of India’s banking system, with gross Non-Performing Assets (NPAs) of scheduled commercial banks and NBFCs falling below 3 percent. The RBI attributed this positive trend to factors such as enhanced provisioning for bad loans, sustained capital adequacy, and increased profitability.

RBI Governor Shaktikanta Das had previously said, “The non-banking financial companies (NBFCs) also displayed strong financials in line with the banking sector. Notably, the gross non-performing assets (GNPAs) of scheduled commercial banks (SCBs) and NBFCs are below 3 percent of total advances as at end of March 2024.”

The Finance Ministry has also noted that various reforms, including the Insolvency and Bankruptcy Code, have played a crucial role in improving the financial stability of banks and reducing bad loans, thereby decreasing overall NPAs.

(Inputs from ANI)