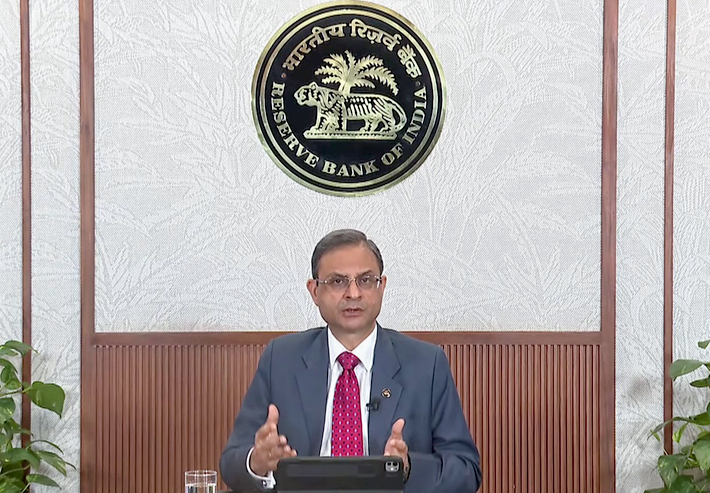

The Reserve Bank of India (RBI) on Friday announced a sharp 50 basis points cut in the repo rate, bringing it down from 6 per cent to 5.5 per cent. Announcing the decision, RBI Governor Sanjay Malhotra said the central bank was responding to the sharp moderation in inflation, which has now fallen to 3.2 per cent — below the RBI’s lower tolerance band of 4 per cent.

In a further liquidity-boosting measure, the RBI also announced a 100 basis points cut in the Cash Reserve Ratio (CRR), to be implemented in four tranches of 25 basis points each on September 6, October 4, November 1, and November 29. This move is expected to infuse approximately ₹2.5 lakh crore into the banking system.

“The repo rate has now been reduced by a cumulative 100 basis points since February. Given this, we are shifting the monetary policy stance from accommodative to neutral to closely monitor the evolving growth-inflation dynamics,” Governor Malhotra stated.

The repo rate — the rate at which the RBI lends to commercial banks — acts as a key benchmark for interest rates in the economy. A cut in the repo rate typically leads to a reduction in lending rates for borrowers, thereby encouraging both consumption and investment.

However, the Governor stressed that the success of the rate cut would depend on timely and effective transmission by commercial banks to consumers.

RBI’s inflation outlook has been revised downward from 4 per cent to 3.7 per cent. The Governor said the moderation in inflation is broad-based, and the alignment with the RBI’s target band appears durable. He also noted that food inflation is likely to soften further on the back of a strong rabi harvest and record wheat and pulses production.

“There has been a considerable improvement in supply-side conditions. The second advance estimates point to a record wheat crop and robust kharif arrivals, which will help contain food prices,” he added.

Governor Malhotra highlighted that the Indian economy remains on a strong footing. Corporate, bank, and government balance sheets are healthy, and the external sector is stable. He said India continues to be the fastest-growing major economy and offers attractive opportunities for both domestic and international investors.

“India’s economic resilience is underpinned by strong fundamentals — demography, digitalisation, and domestic demand,” he said.

Falling crude oil prices have also contributed to the positive inflation outlook, while anchoring inflation expectations going forward.