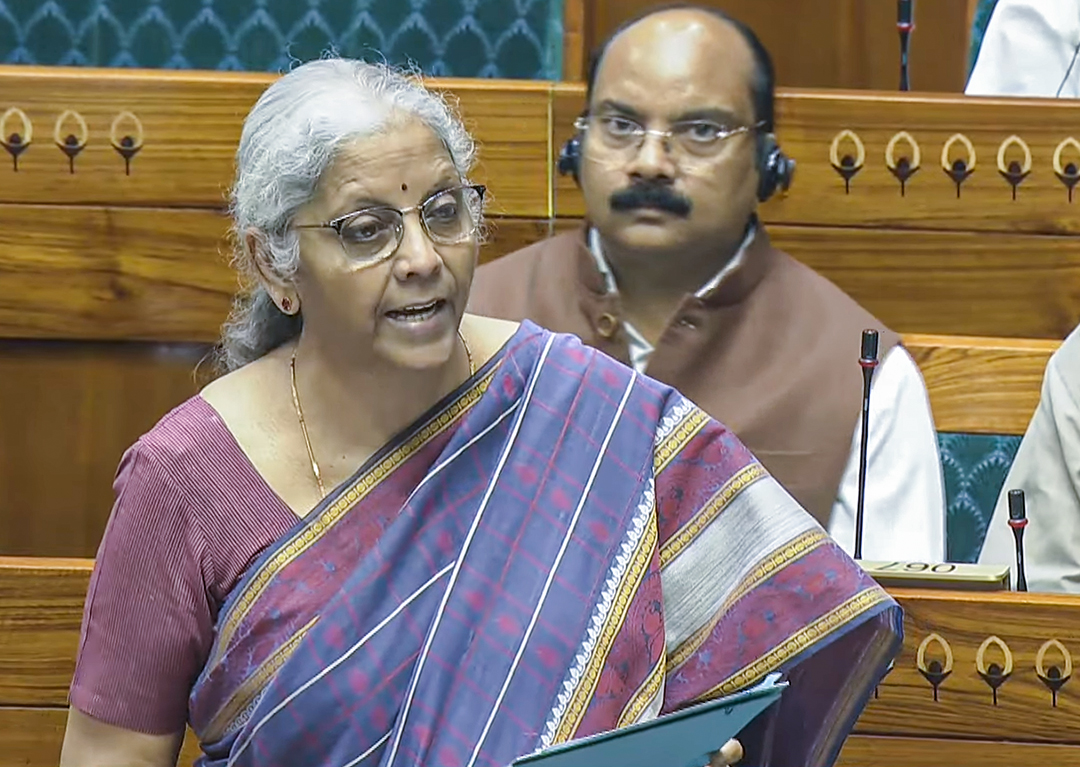

Finance Minister Nirmala Sitharaman on Friday moved to withdraw the Income-Tax Bill, 2025, following suggestions from the 31-member Select Committee chaired by BJP MP Baijayant Panda.

The Lok Sabha approved the withdrawal amid uproar from Opposition members.

The Select Committee’s report on the Income-Tax Bill was presented in the Lok Sabha on July 21, the first day of the ongoing Monsoon Session. The panel’s review aimed to simplify the language and structure of the Income Tax Act, 1961, and align it with the evolving economic and legal framework.

The Committee submitted a comprehensive 4,584-page report, making a total of 566 suggestions and recommendations. These include drafting corrections and stakeholder-suggested changes deemed necessary for ensuring clarity and unambiguous interpretation of the proposed law.

In a move to offer relief to taxpayers, the panel has recommended amending the provision that disallows refunds if income tax returns are filed after the due date.

Additional recommendations include aligning the definition of micro and small enterprises with those under the MSME Act, and clarifying taxation rules for non-profit organisations—particularly around the use of terms like ‘income’ versus ‘receipts’, treatment of anonymous donations, and the deemed application concept, which the committee believes should be removed to reduce potential legal disputes.

The report also addresses procedural issues, recommending amendments for greater clarity around advance ruling fees, TDS on provident funds, low-tax certificates, and the penalty powers granted under the law.

The new Income Tax Bill was originally tabled in the Lok Sabha by Finance Minister Nirmala Sitharaman on February 13, 2025, following an announcement in the Union Budget 2024. The Budget had proposed a comprehensive review of the Income Tax Act of 1961, with the goal of simplifying tax provisions, making the law more concise and understandable, and reducing disputes and litigation.

-ANI